Visionaries and Vanguard

Celebrating Munger and Mapping Berkshire’s Future

Berkshire Hathaway’s self-proclaimed “general contractor,” Warren Buffett, once again held court for the shareholder base this past Saturday. Missing was the late Charlie Munger, who Buffett described as the “Architect” of the Berkshire empire in his most recent annual shareholder letter. Only once did Buffett make the habitual deferral to his former partner, which seems forgivable for a 93-year-old chairman.

In lieu of the typical “Mungerisms”, shareholders were given additional insight from Greg Abel and Ajit Jain, who will, in all likelihood, carry the torch for capital allocation and insurance operations in the next era of Berkshire.

Abel laid out a relatively optimistic case for the expansion of Berkshire Hathaway Energy’s rate base in the coming decade, while also acknowledging persistent underperformance of Berkshire’s railroad operations. Burlington Northern’s profit margin remains substantially below its closest competitor, Union Pacific.

Berkshire’s insurance operations continued its run of strong earnings amidst a favorable pricing environment. Ajit Jain noted that Geico’s data analytics capabilities remain stubbornly behind its primary peer, Progressive. A trend that can be extrapolated by simply comparing Progressive’s superior financial performance over the past decade.

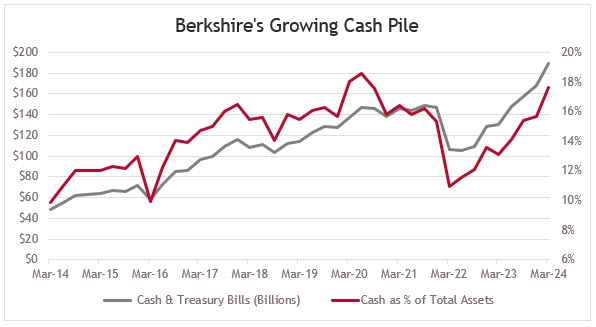

With record operating earnings and net stock sales of nearly $17B in the first quarter, Berkshire’s cash pile continued to swell, jumping to a record of almost $190B in the first quarter. Even if you adjust for the expanded size of its asset base, this constitutes an unnecessarily large percentage of Berkshire’s capital, in our view.

Past performance is not indicative of future results. As of May 3, 2024

If inertia on cash deployment was prevalent with interest rates near zero, it has effectively hit a standstill with treasury bill yields above 5%. Buffett dismissed the relevance of prevailing interest rates on competition for Berkshire’s excess cash, instead reiterating the difficulty in finding “fat pitches” in the current market environment.

With such a narrow list of public and private companies that are likely to fit the criteria for Berkshire’s ownership, in size that matters, the strike zone may be simultaneously shrinking.

Share repurchases have become a primary lever for cash deployment, with Berkshire repurchasing a total of $75B of its own stock over the past five years. But even that cadence slowed to a meager $2.6B in the first quarter, with Buffett attributing lack of liquidity to further repurchases. It is highly likely that cash will exceed $200B at the end of next quarter.

Also noteworthy was Berkshire selling nearly 13% of its Apple position in the first quarter, which still comprised nearly 40% of its public equity portfolio, and just over 15% of enterprise value. Buffett hinted that this could be related to the potential for higher capital gains rates in the future, but we find it hard to ignore the recent expansion of Apple’s valuation as an additional rationale.

As of last Friday, Berkshire Hathaway was the 7th largest U.S. company as measured by market capitalization, closing in on the $1 trillion club. Buffett noted that Berkshire’s $571 billion of shareholder equity is more than $200 billion higher than JP Morgan, the company with the second highest total, illustrative of the economic value that has accrued to Berkshire’s shareholders over time.

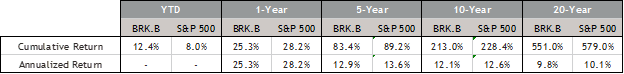

Berkshire’s stock has had a strong start to 2024, with shares appreciating 12.4% through May 3rd, ahead of the S&P 500’s 8% return. Over the past 10 and 20 years, returns have been mostly in-line with the S&P 500.

As of May 3, 2024

As we look forward, deferring to Buffett and Munger’s sage advice that forward expectations should moderate with the size of Berkshire’s business, seems prudent. Operational improvements and opportunistic deployment of excess cash offer some optionality to potential upside, but neither can be assumed. Shares are trading near our estimate of fair value, while also offering some potentially defensive characteristics. As previously stated, we feel that Berkshire is no longer a get rich stock, but a stay rich stock, and we’ve sized our allocations appropriately.

Thank you for your interest in Berkshire Hathaway and if you have any questions as a client, please don’t hesitate to reach out to your Relationship Manager. All other inquiries are welcomed by emailing contact@bridgestrust.com.