Market Commentary Q2 2024

DIVERGENCE

Coming into the year, the biggest hurdles we saw for the stock market were the lofty expectations for corporate earnings and further moderation of inflation. As it relates to earnings, so far, so good. Analyst estimates for both 2024 and 2025 have held steady since the start of the year, which is counter to the historical trend of revisions being biased to the downside.

After an upside surprise in Q1, inflation resumed its trend lower in the second quarter, with the May Core Personal Consumption Expenditures index closing in on the Fed’s target level. Along with some emerging cracks in the labor market, the Fed has an improving setup to start lowering rates in the back half of the year, in our view. We wouldn’t expect significant rate cuts, absent a material economic slowdown, but the path towards easing looks increasingly likely based on recent data and Fed commentary.

With growth stalling in Europe (again), the European Central Bank took the lead on cutting rates in June. Divergent monetary policy makes sense given the underlying differences in economic and financial conditions, but we would expect a general trend towards easing from global central banks over the next few years.

It is also evident to us, that the American economy and businesses maintain structural advantages over developed economy peers in a world of scarce growth, which supports our bias in capital allocation.

As for the U.S. consumer, sentiment has remained somewhat disconnected from activity, with spending holding up better than expected despite the weight of elevated prices. Part of that may be the lingering tailwind of excess pandemic savings, and more recently the wealth effect from rising financial assets, especially the rapid appreciation in home values.

Such resiliency may not last. According to the Federal Reserve, Americans have now spent through the entirety of the $2 trillion in excess savings accumulated during the pandemic, as of the end of March. Along with rising credit delinquencies, and the increasing cost of debt service as a percentage of disposable income, we expect spending to face headwinds moving forward.

Although a slowdown in spending doesn’t sound all-too-rosy for the economy, recession odds in the short-run appear to be low. As we noted in our Q1 commentary, 1995 is the only other Fed hiking cycle since the end of World War II that did not end with a recession. The market seems to be assigning a high probability to this soft-landing scenario, which may be the best possible outcome after such rapid tightening in financial conditions.

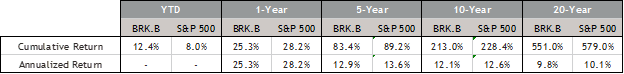

The stock market is off to a very healthy start to 2024, but divergence between winners and losers continued to widen in the second quarter. Despite the S&P 500 gaining 4% in the second quarter, and closing near an all-time high, the S&P 500 equal-weight index, which assigns the same weighting to Apple as it does Campbell Soup, declined 2.6% this past quarter. Year to date, the equal weight index was up 5%, as compared to the 14% gain in the market cap-weighted S&P 500. Small cap stocks, as measured by the S&P 600, declined 3% in Q2 and were down 1% through the first 6 months of the year.

The relative outperformance of the largest companies has so far been commensurate with vastly superior financial performance. For example, in the first quarter, net income for the “Magnificent 7*” increased 52% year-over-year, whereas the rest of the S&P 500 saw net income decline 9%. As we look forward, our views are earnings growth should start to converge for the remainder of 2024 and into 2025. Assuming results meet these relatively lofty expectations, market breadth could improve.

We believe a large part of the optimism supporting corporate earnings estimates centers around the impacts of spending and efficiencies related to artificial intelligence. While we are inclined to discount some of the more extreme forecasts of what this means for economic productivity, we do see the appeal of such major, cross-industry applications. It is also a welcome catalyst to what could go right in a mature economy, when so often the narrative focuses on what could go wrong.

As for valuations, the S&P 500 now trades at 21x earnings, which seems high on an absolute basis, but reasonable if estimates for earnings growth hold up. Valuation is heavily influenced by the top 10 weightings which trade for 30x earnings and now make up 37% of the index. The other 490 companies trade for an average valuation of around 16x, close to the long-term average. Small and mid-cap stocks are also trading near their long-term average valuations, on suppressed earnings.

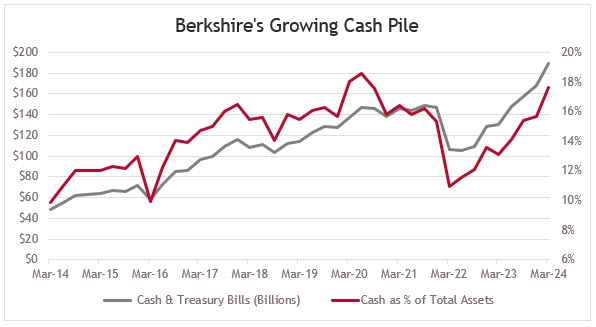

Optimism may be high for the largest companies, and for good fundamental reasons, but we don’t get the sense this bullishness has reached an extreme level yet. Net inflows to equity funds have been underwhelming, and there remains substantial cash parked in money market funds.

We would expect volatility to rise from historically low levels, with the S&P 500 having now gone 340 trading days without a 2% daily decline, the third longest streak of the past 25 years. Sentiment around earnings, Fed policy and the election are likely to be the catalysts to that changing in the second half.

– Bridges Investment Committee

* Magnificent 7 refers to Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla

Market Commentary Disclosure